After the end of lockdown in 2021, the new year of 2022 was supposed to show us what the new normal would be. However, unexpected inflation across industries (including the CPIH goods annual inflation rate that hit the highest on record) meant that 2022 was anything but normal. We look at the trends and statistics for the food delivery industry in 2022.

2022 Rises in Inflation

Although 2021 already had a high inflation rate of 5.4% (up from 1.3% back in 2019), the economic impact of Covid-19 and the Ukraine-Russia war further increased the rate in 2022 with the Consumer Prices Index (CPI) rising 10.1% in the 12 months from January 2022 to 2023.

The rate of inflation over 2022 meant significant cost increases in gas, electricity and food, meaning higher costs of living for the general population and higher fixed costs for companies.

Inflation Meant Rising Costs for Food and Beverage Suppliers

Over the year 2022, the Product Price Index (PPI) for food increased by 17.1%, the highest annual rate on record.

47% of the 10,034 food and beverage businesses surveyed by ONS said that suppliers, production or both had been affected by increases in energy prices in 2022. As a result of price rises in the food and beverage industry, 3.9% of businesses discontinued lines of sale, 57.6% had to absorb costs, 6.5% had to access more financial support, 18.7% had to change suppliers, 2.9% had to make redundancies, 36.9% had to pass on price increases to customers, 10.5% had to reduce staff hours and 2% were unable to maintain workspaces.

As the awareness of the economic benefits of commercial kitchens increased, many food companies moved their operations to rented kitchen spaces in order to save costs. The size of the global commercial kitchen market was estimated at $56.71 billion in 2021, in 2022, they forecast it to grow by almost 100 per cent, to $112.53 billion, by 2027.

Increased Consumer Desire for Convenience Showed Resistance to the Impact of Inflation

Although inflation meant a higher cost of living, consumers proved reluctant to give up the ease and convenience of food delivery apps that they had become accustomed to during the pandemic. It seems Covid-19 has made a long-lasting impact on the way many Britons consume their meals.

According to the Labour Force Survey, the average weekly hours of work will increase by 2.9% in 2022-23. Even at home, longer working hours and time-pressed consumers are swapping home-cooked meals for ordering in. This increased customer desire for convenience has been beneficial to the food delivery industry but has meant a greater expectation level for fast delivery and technology. Consumers want the choice and accessibility of food to be as easy as possible.

Increased workers’ rights for delivery drivers and inflation costs have meant that some struggling restaurants have put the 30% delivery app fee on consumers. Despite this increase in consumer prices, the search trends and research below show that customers are still keen to order their food in.

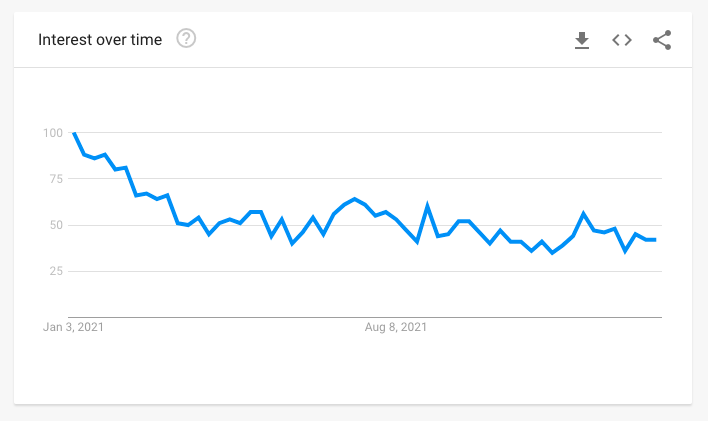

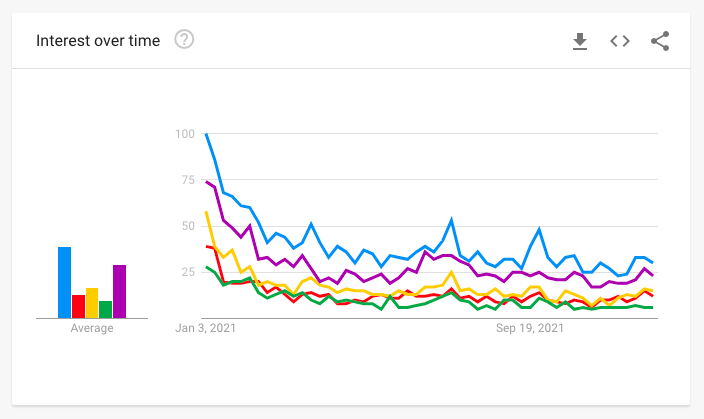

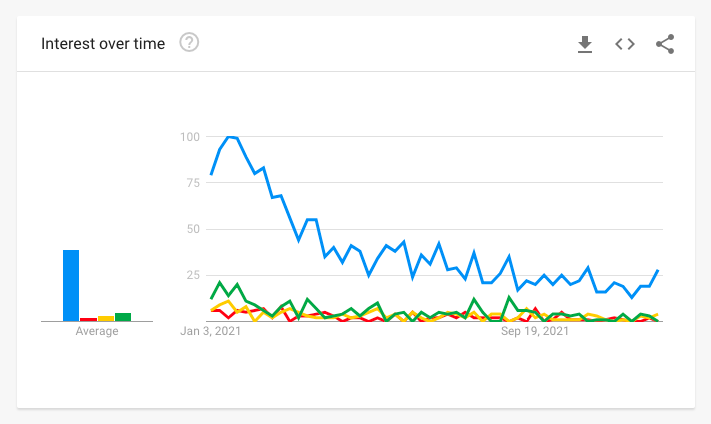

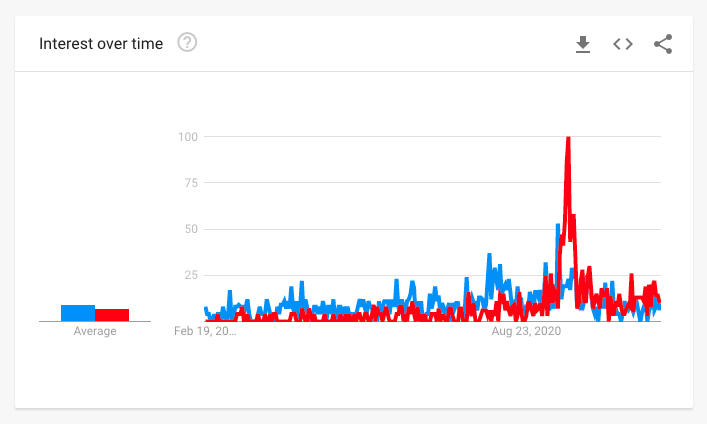

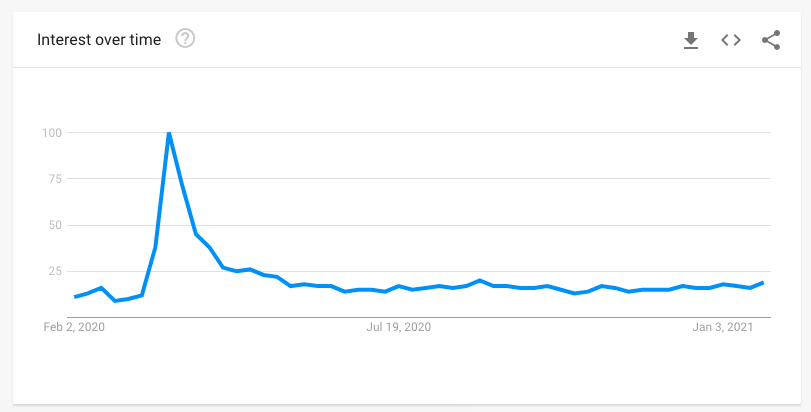

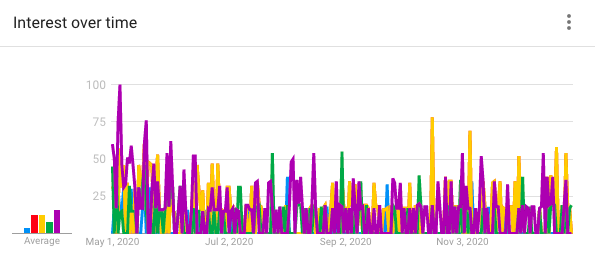

Food Delivery: General Interest 2021-2023

Despite the jump in inflation in 2022 from 2021, Google search trends show there wasn’t a significant level of decreased interest in food delivery over the year.

Food Delivery General Interest 2022

The Ukraine-Russia war was announced in February 2022 and the stark changes in inflation started shortly after. The rate of interest in food delivery started to dip at this time by about 15%, it then stayed fairly consistent thereafter.

Food Trends 2022

Before we compare the food delivery brands and products over 2022, here is a summary of 2022 food trends to illustrate how brands have had to adapt to consumers’ behaviours and desires.

Sustainability

According to the BDO, the biggest topics of interest to come out of 2022 are sustainable food and locally sourced food. 63% of consumers would be willing to pay more for sustainable options when dining out and veganism is still a favoured sustainable option. Nestle Professional confirmed there is continued interest in veganism and plant-based alternatives. Other consumers are opting for flexitarian diets, where individuals predominantly eat plant-based food but still eat meat and animal products from time to time.

Increased Food Prices Impact on Food Trends

According to a FSA survey on consumer attitudes and concerns around food conducted between 26 April and 24 July 2022, food prices were the top concern for people (66%), food waste was second (60%) and the amount of sugar in food (59%) was third.

Mintel in their 2022 report on food delivery found a greater interest in click-and-collect from food delivery apps UberEats, Grubhub, DoorDash, and Postmates. Click-and-collect is a popular option for customers to save on delivery fees, plus it gives them more control over when and where they pick up their food. The Mintel report highlights the popularity of sustainable package solutions and the speed of services for the new convenient-hungry consumer.

Mintel also warns of more consumers making menu comparisons across apps. It is therefore in delivery apps’ interest to partner with favourable food brands and restaurants. For more on how consumers made their food choices in 2022, check our 2022 food trends report.

Food Delivery Brands

The pandemic saw a rise in grocery deliveries as well as hot food delivery apps. 2022 statistics show they are both here to stay.

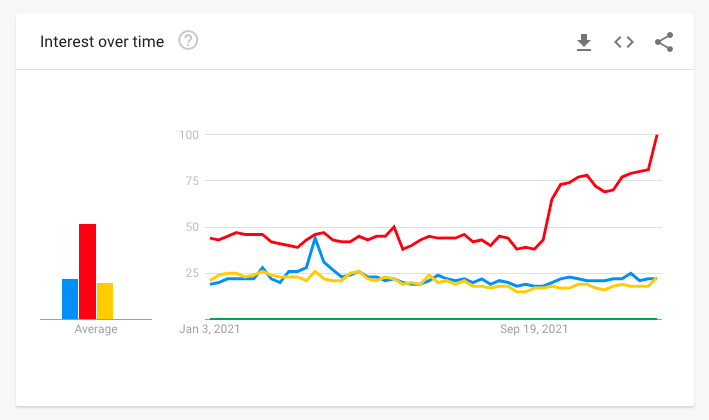

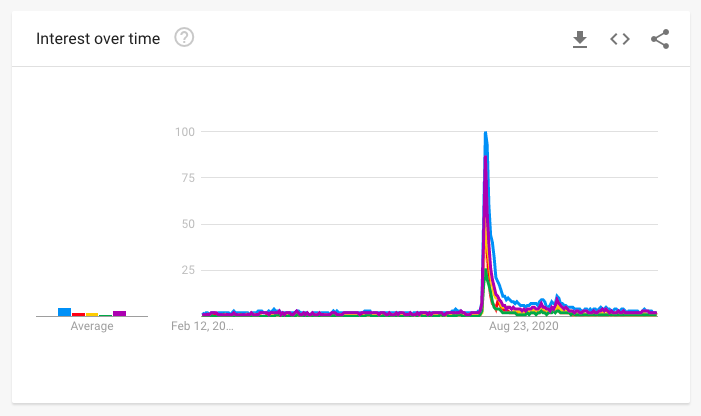

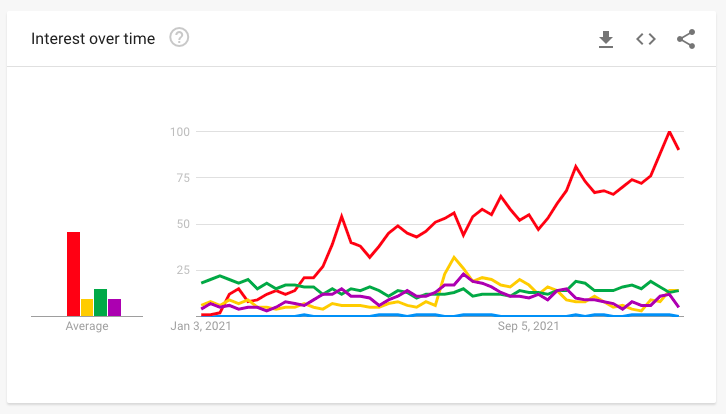

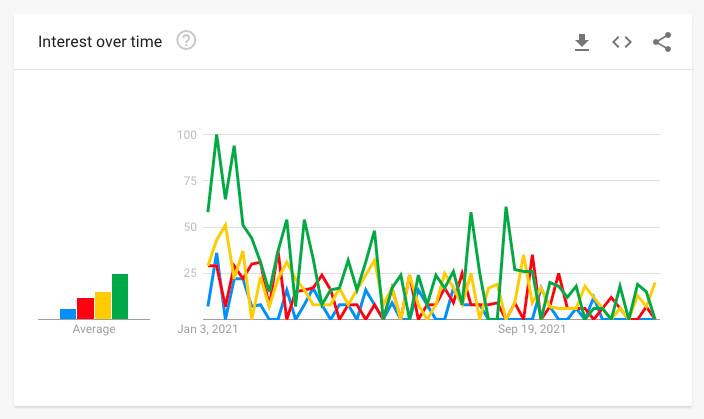

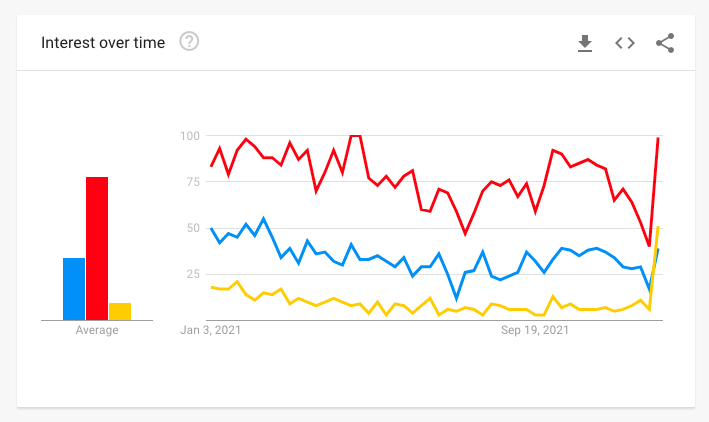

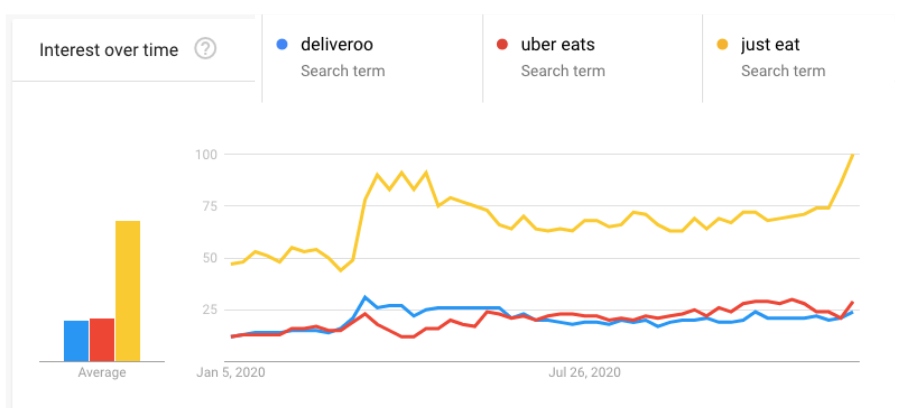

Biggest Hot Food Delivery Apps By Market Share 2021-2023

Just Eat (Red), Deliveroo (Blue), UberEats (Yellow)

Although Just Eat was still the most searched for out of the three competitors in 2022, their huge dip of -40% interest at the beginning of the year meant they had consistently lowered interest throughout the year. This didn’t seem to make an impact on consumer purchases however as their revenues were at €3.636 billion, up from €3.487 billion the previous year.

Although revenues were up, so were costs. Just East had to greatly cut costs in 2022. They had to abandon their employee-only promise in Europe (for their delivery couriers to be salaried employees) and pay them less consistently.

Whilst Deliveroo and UberEats were fighting over second place in 2021, Deliveroo was the clear winner between the two in 2022. Yet, not all attention is good attention. Deliveroo hit headlines in November 2022 when their London-listed shares lost around half of their value since the start of the year. Despite more Google interest in Deliveroo, UberEats beat Deliveroo in terms of users, as they consistently have over the years. UberEats had 85 million users, Deliveroo had 7.4 million. In Q4 2022 UberEats’ business performance exceeded analyst expectations, with delivery revenue still jumping 21% year on year.

Grocery Delivery

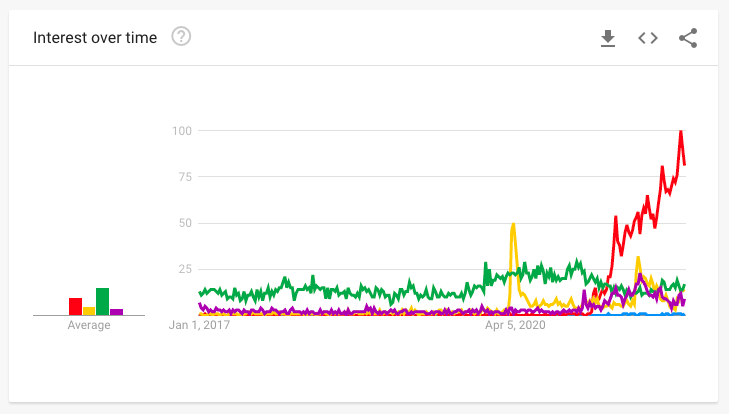

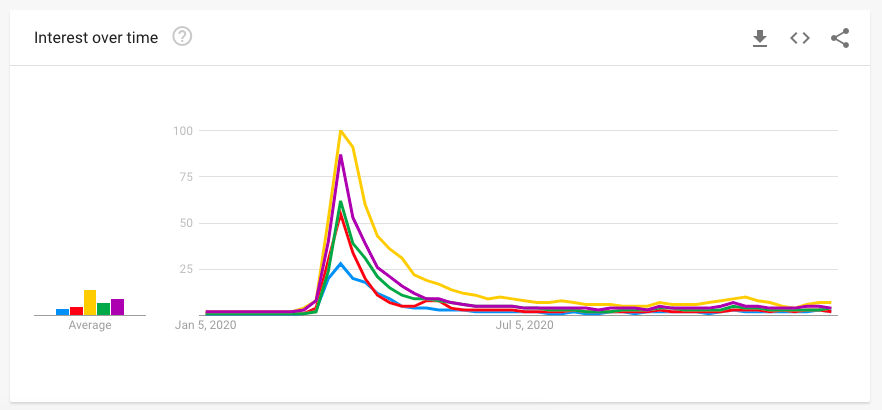

The 5 UK Supermarkets 2021-2023

Tesco (Blue), Sainsbury’s (Red), Morrisons (Yellow), Waitrose (Green) and Asda (Purple)

Interest in Supermarket Deliveries

As predicted, the number of searches for grocery delivery decreased in 2022 as households moved out of lockdown and were no longer dependent on home deliveries. The following stats from 2022 give a good indication of what the next few years will look like.

Comparing the Top 5 Supermarkets

Due to Asda’s devotion to low price offerings throughout 2022, (topping the Grocer 33 weekly price comparison survey 37 out of 50 times) their interest started to catch up with Tesco towards the latter half of the year. Surprisingly, the more costly option of Waitrose started to catch up with Sainsbury’s search volumes. This could be due to Waitrose’s DIY lunches offering, a bid to “make people’s money go further”.

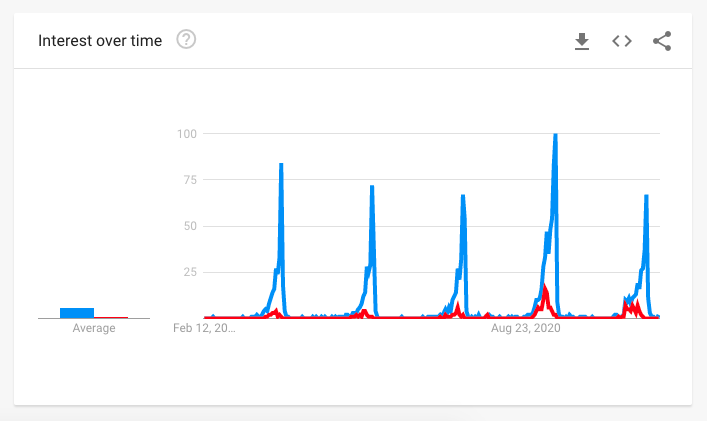

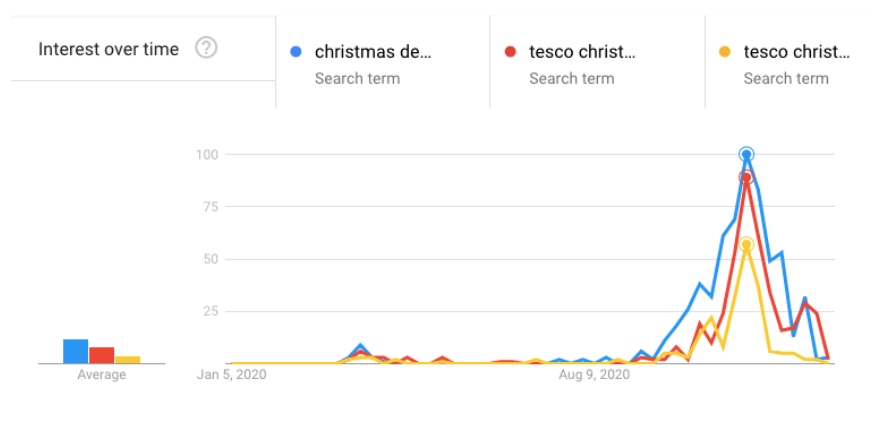

Supermarket Christmas Delivery: Top 5 UK Supermarkets In The Past 5 Years

Tesco (Blue), Sainsbury’s (Red), Morrisons (Yellow), Waitrose (Green) and Asda (Purple)

Although Tescos had a slight dip in 2021, their interest went up again in 2022 keeping them far in the lead for the most popular supermarket for Christmas delivery.

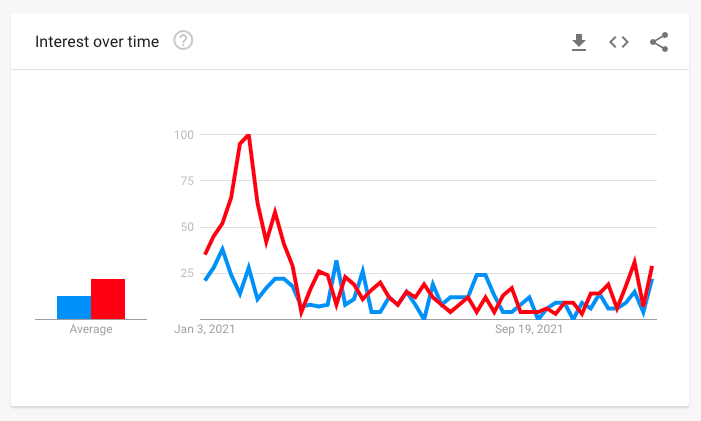

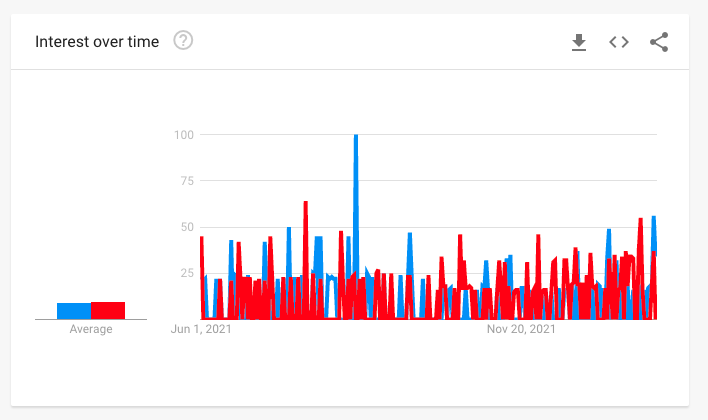

‘Christmas delivery’ (Blue) Compared With ‘Christmas delivery slots’ (Red) 2021 and 2022

With more people out of the house and shopping returning to normal, it’s no surprise that Christmas delivery searches were less popular in 2022 than in 2021. Nevertheless, interest in Christmas delivery was still relatively strong, again suggesting that the consumer habits around food delivery that increased during the pandemic are here to stay.

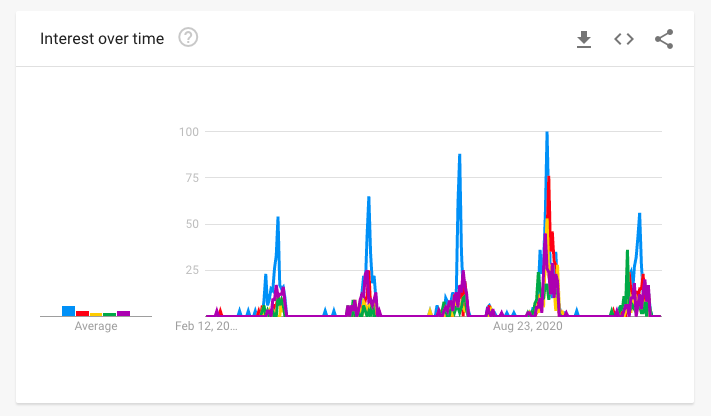

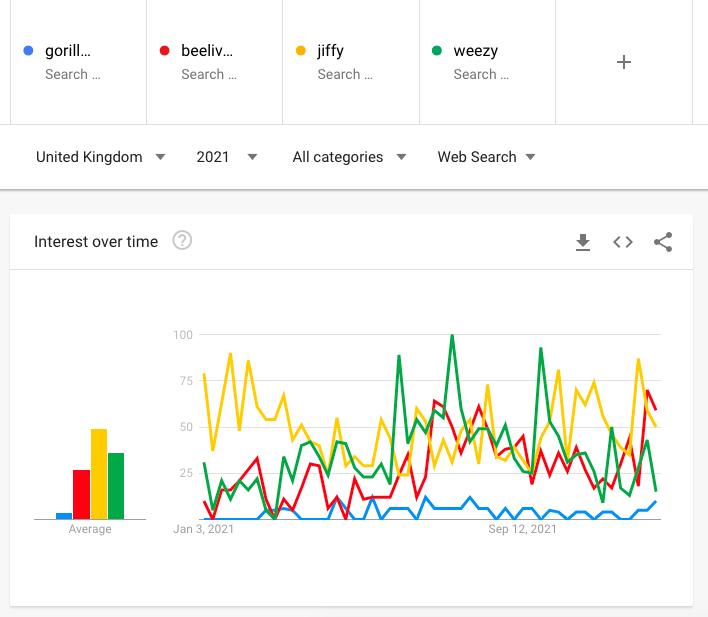

New Food Delivery Startups: The Last 5 Years

Getir (red) Gorilla Grocery (blue), Beelivery (yellow), Jiffy (green) and Weezy (purple)

The popularity of the new food delivery startups has come from their use of technology to increase the speed of delivery and match consumer desires.

Getir’s use of deep inventory data and AI to constantly learn about their customers and provide ultrafast delivery explains their popularity with the 2022 consumer. They noticed a particular spike in alcohol sales during the Fifa World Cup this year because those watching at home wanted to top up their beer supply quickly and easily.

After falling in position in 2021, Jiffy made it back up to second place in 2022. This was probably due to their strategic pivot to increase delivery times using their rapid software. They also set themselves apart from the competition by launching their own-label range, offering click-and-collect, providing baked goods from dark stores and increasing partnerships with desired brands such as BrewDog.

Food Boxes

Food boxes are at-home cooking kits that include everything for a meal (or multiple meals). The key selling point of food boxes is their offering of a particular type of niche food, such as artisan foods or foods from small and local producers.

While the spike in interest in early 2021 was due to the convenience of delivery during the pandemic, interest in food boxes remained high and fairly level in 2022 despite rising inflation.

Types of Food Box 2021-2023

‘Meat boxes’ (Red), ‘Fruit boxes’ (Yellow), ‘Veg boxes’ (Green), ‘Fruit and veg box’ (Blue)

Veg boxes are the most searched for food box, which could be attributed to the veganism trend. Interestingly, in Northern Ireland, it is only veg boxes they are interested in.

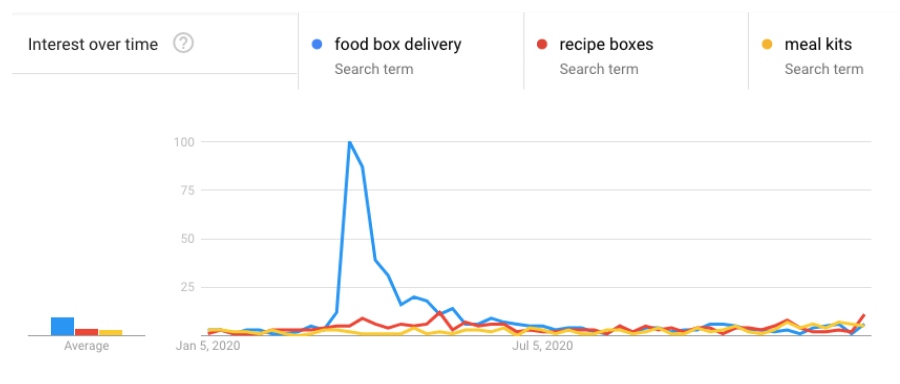

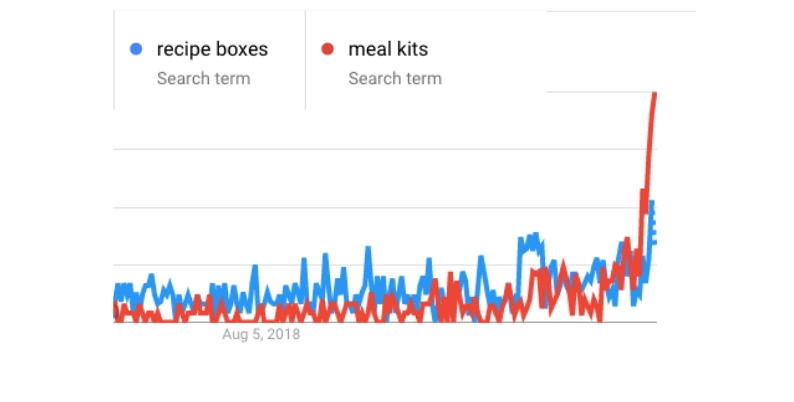

Meal Kits vs Recipe Boxes

Meal kits provide complete pre-prepared or pre-cooked ingredients for a meal whereas recipe boxes typically only provide the raw ingredients or unique components to make a meal. Meal kits mean less time is needed to cook the food or buy the main ingredients, which makes them more convenient but usually more costly.

‘Meal kits’ (Red) ‘Recipe boxes’ (Blue)

As predicted, meal kits are still more popular than recipe boxes due to their convenience, but their popularity has been decreasing now that people have more freedom to go out and buy the ingredients themselves. The rising costs of living make the convenience of recipe boxes more of a luxury that consumers will forego when trying to save money.

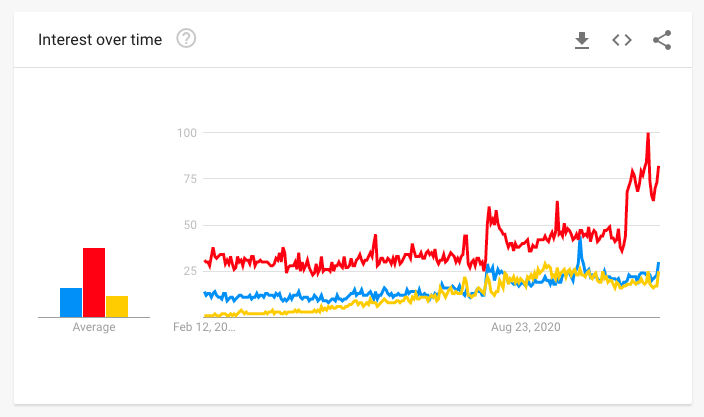

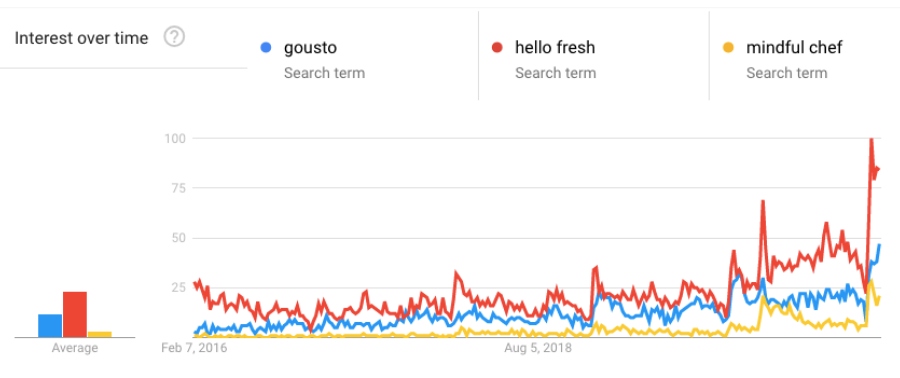

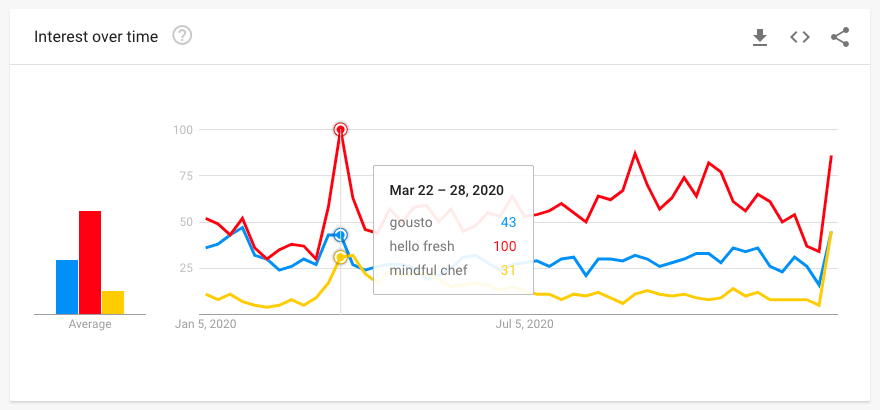

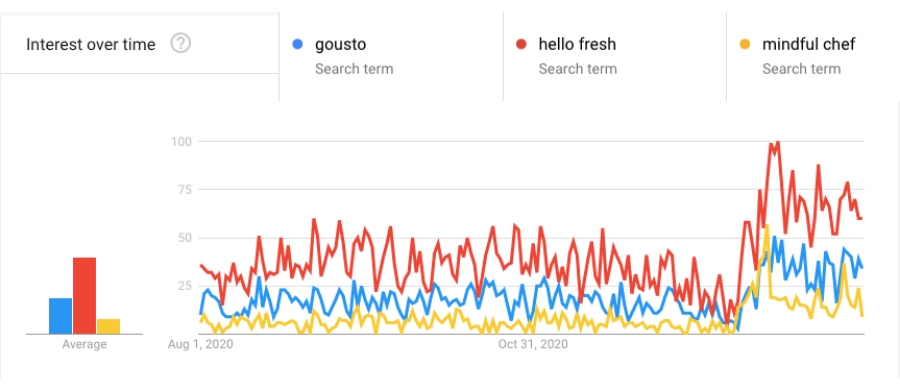

Meal Kit Brands 2021-2023

Hello Fresh (Red), Gousto (Blue), Mindful Chef (Yellow)

All three brands experienced a sudden spike in interest around January 2nd-8th 2022. This could be attributed to the general rise in awareness of meal kits. The war then caused a sudden drop in interest when they were seen as a less affordable option.

Conclusion

In summary, while 2022 was a tough year for the entire food industry and consumers alike, interest in food delivery was still high due to its convenience. Food brands have found new ways to cut costs and appeal to consumers using developments, mainly in technology. It’s good to know that consumption of food delivery appears to be fairly resistant to economic crisis but also that if inflation lowers, as predicted over 2023, food delivery consumption should rise again.

What Will 2023’s Statistics Reveal?

2023 has already seen a decrease in inflation and the Guardian expects it to halve over the year. Food delivery apps have already signalled that they are expecting a surge in demand.

With the huge upheaval in AI, apps will continue to use technology to meet the needs of consumers and speed up delivery times. They will endeavour to find new ways to use digital data to improve customer experience and also invest in further application improvements such as referral program rewards, saved favourites, recommendations based on usage history, in-app chat rooms and the ability to send pictures for hard-to-find addresses.

Consumer desire for speed and convenience is here to stay with people working more hours and having busier schedules since the pandemic. The benefits of food delivery discovered in 2020 will always be considered beneficial to the modern consumer.

Read More About the Latest Food Trends

Take a look at our 2023 Food Trends to see what we’ll be eating and where in the year to come. Or read on for the food delivery statistics we gathered back in 2021.

2021 was a significant year in the COVID-19 pandemic. In the UK, 2021 saw an end to lockdowns, an easing of restrictions and, in the latter half of 2021, people venturing back out into the wider world – with only minor safety suggestions, like optional mask wearing. So what did all this change mean for the food sector and specifically for food delivery, which had thrived while we were unable to dine out?

Using Google Trends, ‘a largely unfiltered sample of actual search requests made to Google‘, and research from across the sector, we’ve taken a look at food delivery in 2021, from popular delivery apps to niche online orders.

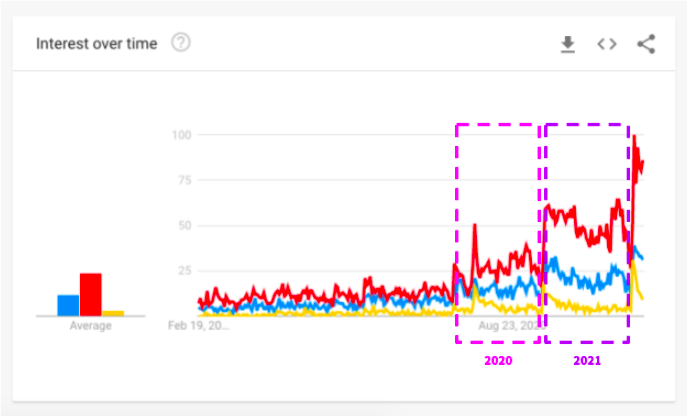

Food Delivery – General Interest

Interest in food delivery dropped by 50% over the course of 2021

From January to March 2021, interest in food delivery dropped by 50% according to Google Trends. It remained at this lower level for much of the year and into January 2022.

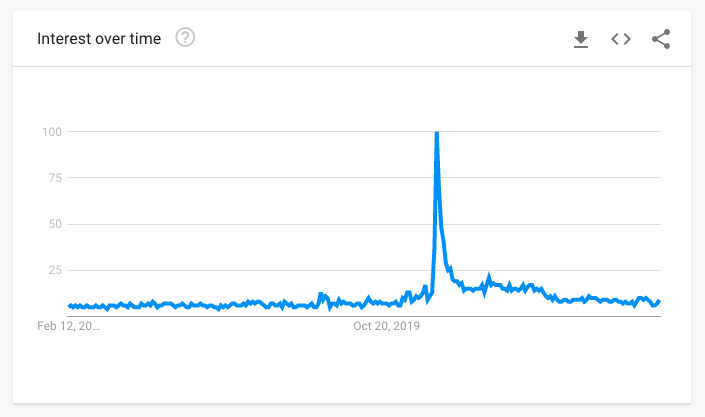

Food delivery interest appears to have returned to pre-pandemic levels

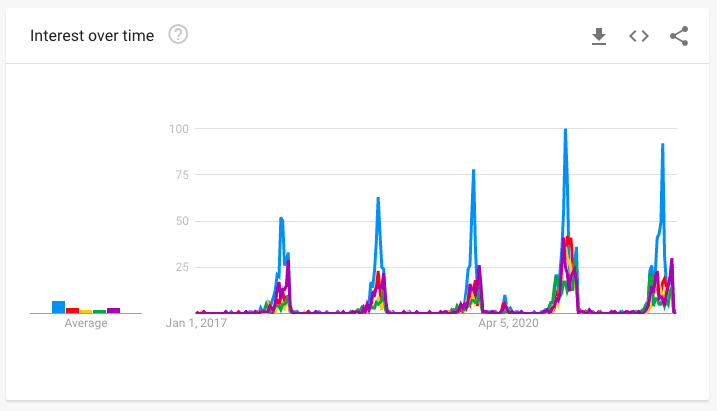

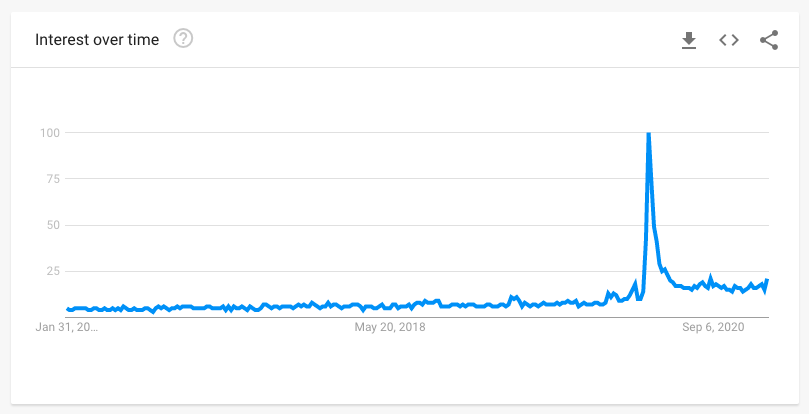

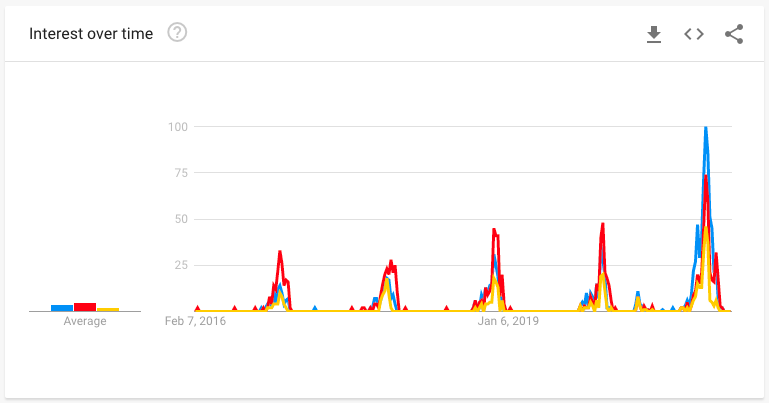

Food delivery had been on the rise. This graph from Google Trends shows data from February 2017 to 2021:

We can see a steady rise in interest in food delivery, which starts to really grow in 2019 and into 2020. The peak occurs in March 2020 when the first lockdown was announced. If we compare the interest level before the spike to the level at the end of the graph, which is February 2022, they are similar – bar the natural oscillation of interest that occurs from week to week and month to month.

The most significant question about food delivery for 2022 is whether interest remains at the level it is at now, or returns to the steady growth we saw in 2019 and early 2020, pre-pandemic.

Food Delivery Brands

Interest in food delivery may no longer be booming, but does that mean that delivery brands have suffered as a result? And are customers becoming more selective about who they order from and how?

Food Delivery Apps

Naturally, the increase in food delivery and the need for food businesses to pivot to new options has led to new competitors in the food delivery space. To a certain extent, they can be divided into two main groups:

- Hot food delivery – food that arrives at your door, ready to be enjoyed.

- Ambient and chilled food delivery – this includes anything unheated, from tinned food and cornershop snacks to chilled and frozen items from a supermarket.

Both were popular in 2021, particularly when there were limits on the number of people in supermarkets so queues could be extensive. Hot food delivery, the only real at-home treat – unless you were willing to put on shoes to go outside – was likely to have been most impacted by restrictions ending.

Hot Food Delivery Apps

The biggest players in the hot food delivery market are: Just Eat, Deliveroo, Uber Eats. Though they certainly aren’t the only ones, they have the most significant market share. Naturally, all of these sites also have their own apps, whose data we can’t access, but we can get an indication of their popularity from Google Trends.

Interest in Just Eat was 75% higher than its competitors by the end of 2021

Key: Blue = Deliveroo, Red = Just Eat, Yellow = Uber Eats, Green = Food Panda

We can see the 2021 interest rates for each brand in Google Trends, with the addition of Food Panda. WhileGoogle recognises Food Panda as a significant competitor, it’s clear from Food Panda’s flat green line in 2021 that the other three are the main competitors in this space.

Just Eat had a standout year, starting with twice as much interest as Deliveroo and Uber Eats. From October 2021, there was a significant growth in interest in Just Eat. They ended 2021 with 50% more interest than they started with and 75% more interest than Deliveroo and Uber Eats.

Just Eat was popular, but not just for food delivery

It’s worth noting that not all of Just Eat’s surge in interest may have come from consumers ordering food. Since Google Trends includes all searches, regardless of intent, we may be able to attribute some of the Just Eat interest to two significant news pieces at that time:

- Investor demand for Just Eat to split off or sell its US version: Grubhub

- A Just Eat ‘loophole’ where customers can cancel orders they have received, forcing a refund, was reported to hit small businesses hard.

Nevertheless, Just Eat reported that it had taken 1.1 billion orders in 2021, an increase of a third in orders compared to 2020.

The top hot food delivery brands saw an increase of at least 50% across 2021

Food delivery from these top hot food brands doesn’t seem to have slowed in 2021. Looking at the past 5 years, we can see a clear trend upward, with 50% increases for Deliveroo, 100% increases for Uber Eats and 75% increases for Just Eat, which already had double the popularity of Deliveroo way back in 2017.

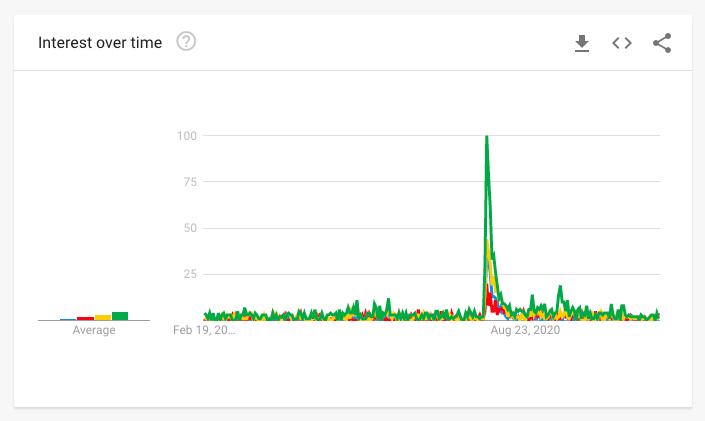

Grocery Delivery

Grocery delivery was certainly important in 2020, particularly for those who either couldn’t or didn’t want to go to the shops during the pandemic. Supermarkets were the core source of these orders, but they weren’t the only ones. As with food delivery, new local and startup grocery delivery services emerged to challenge the big chains by targeting those wanting to support local businesses and do their online food shopping in an eco-friendly way.

Let’s take a look at how five of the biggest supermarkets did in 2021.

Supermarket Food Delivery

Looking at delivery by supermarket, we can compare Tesco (Blue), Sainsbury’s (Red), Morrisons (Yellow), Waitrose (Green) and Asda (Purple).

Interest in supermarket deliveries declined quickly in January 2021

We can see a clear universal decline in interest for delivery from all the major supermarkets. For the most part, they maintained their relative popularity with Tesco and Asda holding on to the top two positions.

Compared to the last 5 years, we can see that 2020 was an anomalous year, with a huge surge in interest in supermarket food delivery for a limited period of time.

What we can discern though is that interest in supermarket delivery has returned to at least pre-pandemic levels, if not higher. It will be interesting to see if this levels out in 2022 as it is likely to be an indicator of what the next few years will look like.

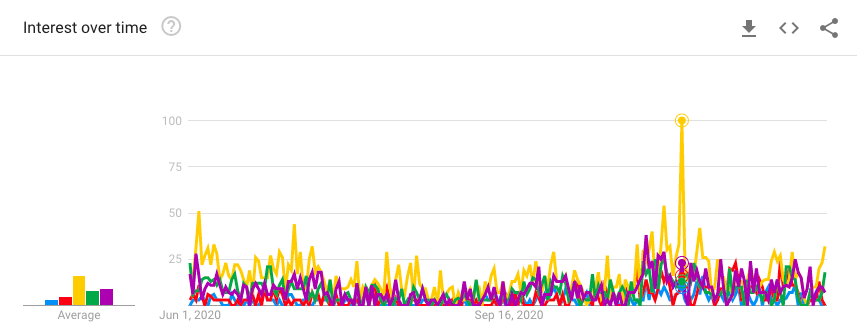

Christmas Delivery Slots

2021 was a very different year to 2020, with far fewer restrictions in place for mixing households, no last minute lockdown announcements and people weren’t impeded from their Christmas plans with family and friends. This would seem likely to change behaviour when it came to booking Christmas delivery slots.

Interest in supermarket Christmas delivery dropped 30%

A cursory look at ‘christmas delivery’ (blue) and ‘christmas delivery slots’ (red) indicates that, as one might expect, 2021 was at the same level as 2019. It’s significantly lower than 2020, approximately a 30% drop.

Christmas delivery broken down by supermarket shows a nearly 50% reduction in interest

We can see a similar trend when looking specifically at Christmas delivery from the five major supermarket chains: Tesco (Blue), Sainsbury’s (Red), Morrisons (Yellow), Waitrose (Green) and Asda (Purple).

Interest in Christamas delivery more or less halved between 2020 and 2021, reaching levels of interest comparable to 2017, much lower than both 2019 and 2018. However, if we look more specifically at ‘Christmas delivery slots’ from the major supermarkets, an interesting difference is clearly visible.

Tesco continued to be the most popular supermarket for Christmas food deliveries

Here, we see that although levels of interest are lower for many of the supermarkets, the levels for Tesco are not nearly as low as in 2019 or before. In fact, they are very near 2020 levels. This could indicate a difference in the customers of the various supermarkets and their Christmas food delivery needs. Perhaps Tesco shoppers were more inclined to get their orders sorted ahead of time while other supermarket shoppers preferred to go to the shops to get their Christmas food.

The Google Trends data also shows that interest started peaking much earlier in 2021, in October, whereas the peaks were only reached in November in 2020. Preparedness and possible concern around restrictions, plus the experience from previous years, seems to have focused customers on planning for Christmas sooner.

New Food Delivery Startups

Major retailers do give a good, broad view of the interest in food delivery. But, they aren’t the whole market. Smaller brands, local producers and startup food apps have been popping up. 2022 food trends indicate that local, more sustainably sourced food is becoming increasingly important to the average consumer. This is part of what these new food delivery apps are tapping into.

Many of these new grocery delivery competitors are using speed as their unique selling point (USP). Delivery within an hour or less is a common way for these brands to set themselves apart from supermarkets, whose delivery slots are at best next day, depending on the popularity of a particular time or day. All include a delivery fee, with some free delivery offered to new customers or for orders over a set amount.

Although there are lots of these new food delivery and grocery brands out there, some of the most established (so far) include:

- Getir

- Gorillas Grocery

- Beelivery

- Jiffy

- Weezy

One of the biggest drawbacks for these brands, at the moment at least, is that they are small. This means often they only operate in limited areas, namely major cities. Some, like Getir, are only available in London, while Beelivery has a more expanded reach of 300 towns and cities, including Edinburgh, London, Oxford and Southampton.

Getir grew 100% in 2021, with a steady rise, while competitors remained level throughout the year

2021 showed a steep increase for Getir (red), compared to the other brands: Gorilla Grocery (blue), Beelivery (yellow), Jiffy (green) and Weezy (purple). It’s worth noting that although Getir launched in 2015, the Turkish grocery delivery service only debuted in the UK in 2021. This data shows the huge response to the brand’s launch in London, amidst COVID-19.

Jiffy increased nearly 50% in 2020 and then dropped again in 2021

Looking at the past 5 years, there was a clear boost to Jiffy (green) in 2020 that was then lost in 2021, in fact dropping a little below its average from 2019. Interest in Jiffy looks to be heading back up in 2022, though who knows for how long.

As for the other competitors, 2021 was a solid year for Jiffy (yellow) and largely positive for Weezy (green). Beelivery trended upwards, ending the year with a 50% increase in interest compared to the start of the year. Gorilla Grocery seemed to languish by comparison, barely registering against its competitors.

What’s to come for grocery delivery? It could be that grocery delivery becomes as commonplace as hot food delivery, particularly if big players get involved, like how McDonalds bought into dark kitchens and helped to legitimise chains using commercial kitchens outside of their restaurants. The first big brand is already looking to test using commercial kitchens for grocery delivery, with Waitrose partnering with Deliveroo on Deliveroo Hop.

Food Boxes

Food boxes can mean produce boxes or recipe boxes. Produce boxes are typically meat, dairy, vegetable or mixed produce boxes with an array of seasonal or local items. Recipe boxes are at-home cooking kits that include everything for a meal (or multiple meals) with ingredients in the set amounts required.

In our 2020 food delivery review, we discussed the huge spike in interest in food boxes during the first UK lockdown in March 2020. This waned from May 2020 onwards, though interest levels were then consistent for the remainder of 2020. So what happened in 2021 as we emerged back into the dine-out world?

Produce Boxes

Produce boxes come in an array of combinations, with common items such as:

- meat

- dairy

- vegetables

- fruit

- bread

A key selling point is that the produce comes from small and local producers. Many brands will also lean into either artisan foods, like sourdough bread or coffee from independent roasters, or non-standard items, like ‘wonky vegetables’ and oddly shaped fruit, which supermarket standards would otherwise reject.

General interest in produce boxes declined, but interest in specific kinds of food boxes didn’t

Looking at 2021 as a whole, ‘food boxes’ (blue) gradually dropped in interest from February to April 2021. This approximate 60% drop from its peak then remained relatively steady, eventually landing at 75% less than its start-of-the-year best.

Interest in specific food boxes, ‘meat boxes’ (red), ‘fruit boxes’ (yellow) and ‘veg boxes’ (green), seems to have remained steady across much of the year. However, if we look at just these terms, we can see there were quite erratic changes in interest throughout the whole of 2021.

Note: Blue = ‘fruit and veg boxes’ in this visual.

Although there is something of a downtrend among the types of food boxes, there is still a consistent market for them. Among the varieties of food boxes, vegetable boxes (green) are the most popular – this is not surprising given that the rise in veganism and environmentally conscious eating has led to a decrease in meat eating for many in the UK. If a food business were considering getting into the food box market, vegetables would be the place to start.

In the context of the past five years, it might appear that food boxes dropped back to pre-pandemic levels following the spikes around lockdowns, but actually they are maintaining an elevated level. It seems that COVID-19 has changed the buying habits of at least a small but significant portion of consumers.

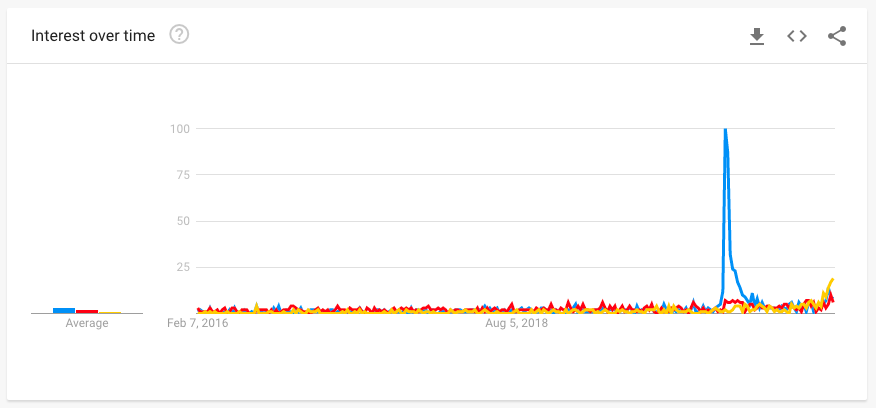

Recipe Boxes

Recipe boxes, also referred to as meal kits, proved to be popular during the pandemic, helping many people fight food boredom and encouraging the less culinarily inclined back into the kitchen. Looking at 2021 as a whole for both terms, we can see that ‘meal kits’ (red) started off more popular but soon dropped to the steady interest levels of ‘recipe boxes’ (blue).

Looking at ‘recipe boxes’ and ‘meal kits’ over five years, we can see that the increased interest that began before the pandemic has become the new normal level for 2021 and into 2022.

We are unlikely to see an abandonment of these kinds of food boxes in 2022 given that during the last 6 months (June 2021 to February 2022) there have been consistent levels of interest in both.

Meal Kit Brands

There are plenty of meal kit brands already on the market, and more are emerging thanks to an increased interest in food delivery as a result of COVID-19 restrictions. As with hot food and grocery delivery, the big meal kit brands have become well-known, leading more people to search directly for their services and not just for generic terms such as ‘recipe boxes’ or ‘meal kits’.

Last year we looked at three of the most popular recipe box brands:

- Gousto

- Hello Fresh

- Mindful Chef

Interest in all these brands had been growing over the last few years and grew steadily across 2020. But what of 2021?

Hello Fresh was 50% more popular with consumers than its next biggest competitor in 2021

Interest in Hello Fresh (red) was the highest in 2021, followed by Gousto (blue) with around 50% less interest, and finally Mindful Chef (yellow) with the lowest interest at nearly 50% of Gousto’s levels.

What is interesting about these three competitors is that there was clearly some seasonality at play. Heading into the summer, all saw dips in interest levels, followed by spikes in interest in the New Year – a time when people often try to get back into cooking and eating in a healthier way, etc.

2020 was a bumper year for meal kit brands, but 2021 beat it. And interest looks to grow even further in 2022.

Looking at the last 5 years, we can see interest in these brands grew significantly in 2020 and then doubled in 2021. Interest levels in 2022 are the highest yet. Interest grew by 25% on average from 2020 to 2021 and by nearly 50% on average from 2021 to 2022.

What will 2022’s Food Delivery Statistics reveal?

The COVID-19 pandemic really shook up the world and the food sector experienced huge changes. Consumers adjusted to a new way of living, by cooking at home and ordering food delivery more often than they had before. Google Trends data indicates that while restaurants are open and people are able to dine out again, not everyone is returning to their previous eating habits and that some pandemic-borne innovations are here to stay.

2022 looks set to be another interesting year in the food and drinks sector, with further developments expected in the way consumers use supermarkets and food delivery. New competitors are likely to emerge, both locally and nationally, catering to these changes in demand with an ever expanding range of options.

Read more about the latest food trends

Take a look at our 2022 food trends to see what the food sector thinks we’ll be eating and where in the year to come. Or read on to read about the food delivery statistics we gathered in 2020.

Food Delivery Statistics: 2020 In Review

To begin, let’s look at ‘food delivery’ as a search term and a general indicator of the category as a whole. You could probably guess that food delivery spiked in the UK when the first lockdown began on the 16th March 2020.

At the start of the COVID-19 response in the UK, many thought that this unprecedented lockdown would last a few weeks and then life would return to normal. Food businesses, from cafes to restaurants, largely moved to a takeaway model or closed for a few weeks, while food delivery businesses and takeaways continued as normal. For many, ordering food was a treat to help them get through the first lockdown, but as restrictions continued, interest waned.

However, though food delivery interest levels had reduced by June 2020, they remained at a higher interest level than had been achieved in 2019 and in fact the highest level of the previous 5 years. This new 2020 food delivery interest level was double that of 2019.

Food Delivery Brands

While overall interest in food delivery was up, what did that mean for specific providers of food delivery? Looking more specifically at popular food delivery companies, we can see how the pandemic affected the interest in their services across the year.

Taking three of the biggest providers: Deliveroo (Blue), Uber Eats (Red) and Just Eat (Yellow), we can see that their popularity spiked considerably during the first lockdown.

In fact, Deliveroo saw an initial 70% increase in March 2020, and Uber Eats saw a 65% increase. Just Eat saw a 54% increase in interest. It is worth noting that interest in Just Eat was 70% higher than both Deliveroo and Uber Eats to begin with.

Further into 2020, particularly in the latter half of the year as lockdowns eased and the tier system came into effect, along with the Government’s Eat Out To Help Out initiative, the interest in all these delivery services levelled out. However, none returned to their previous lower levels.

Interest in food delivery for at least some people continued, perhaps due to inability to get to grocery stores or, for those more financially well off, for simplicity so they didn’t have to cook and could have a variety of foods delivered straight to their door.

The Google Trends graph also shows that interest spiked for Deliveroo, Uber Eats and Just Eat during the third UK lockdown, from December 26th 2020, and remained at elevated levels throughout the rest of Christmas and into January 2021.

Supermarket Deliveries

Naturally, not everyone was jumping to order hot food. Many were simply keen to get regular groceries in. For some this could have been due to needing to shield or isolate, while others might have been avoiding going to supermarkets due to concern about COVID-19 transmission.

Those who did go to the supermarket, particularly at the start of the first lockdown, found that some people had taken to stockpiling certain items, like toilet roll and tinned foods, making them hard to get hold of. Consequently, people turned to supermarket deliveries to try and get a future order in and so avoid missing out.

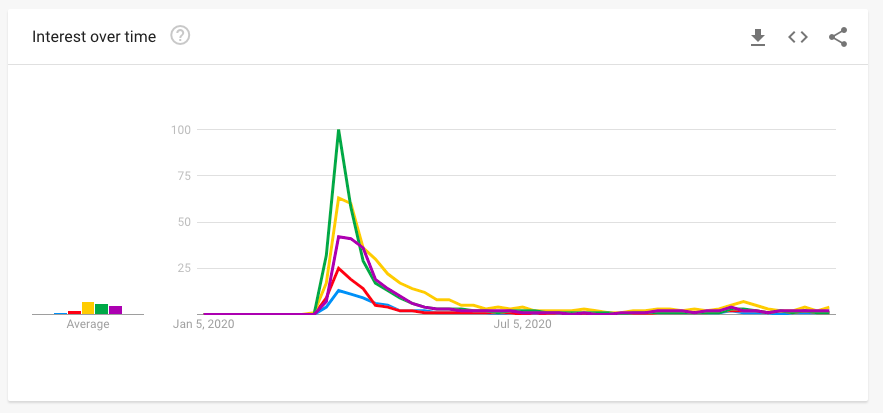

Looking at Google searches for delivery from the main supermarkets, we can see a clear increase in interest across five of the biggest brands during the first lockdown: Tesco (Yellow), Asda (Purple), Morrisons (Green), Sainsburys (Red) and Waitrose (Blue).

Similar trends appeared for Ocado and M&S delivery but are not shown in the graph as they were at a much lower interest level comparatively.

Supermarket Delivery Slots

Delivery slots ran out quickly during the start of the pandemic and this continued for much of 2020 and into 2021. But people kept checking in to see if they could snap up a slot as new ones became available. This is reflected in the growth of searches for supermarket specific ‘delivery slots’.

Google Trends reveals clearly that the interest in delivery slots for various supermarkets hugely increased in March and April 2020.

Looking at the interest levels for supermarkets deliveries, for most it was negligible before the lockdowns (see pictured graph with markers).

While Tesco was the most popular supermarket for ‘delivery’, Morrisons was the most popular for ‘delivery slots’.

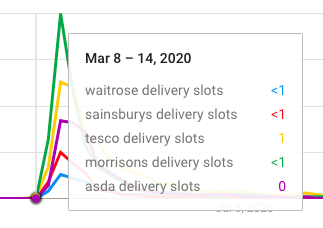

The huge increase in interest in delivery slots during the first lockdown makes it hard to gauge on the graph what levels were like in the rest of 2020, compared to before it started. Looking at the Google Trends results from June 2020 to the end of the year offers a clearer view:

Note: The same supermarkets are in the same colours: Tesco (Yellow), Asda (Purple), Morrisons (Green), Sainsburys (Red) and Waitrose (Blue).

Note: The same supermarkets are in the same colours: Tesco (Yellow), Asda (Purple), Morrisons (Green), Sainsburys (Red) and Waitrose (Blue).

Interest in delivery slots remained at an elevated level for the second half of the year with Tesco having the most interest by a 50% margin over the next most popular supermarket, Asda. Lower levels of interest were found during August and September, but interest in supermarket delivery slots spiked again in November in the run up to Christmas as customers sought desirable Christmas delivery slots.

Supermarket Christmas Delivery Slots

Looking specifically at Tesco as an example, we can see clearly that interest in Christmas deliveries peaked between the 8th and 14th November.

When comparing those interest levels to the past 5 years, we see a more than 350% increase in interest in Christmas delivery slots in 2020 compared to 2019.

Food Boxes

‘Food boxes’ is a somewhat broad term for users making searches in Google, but it can include:

- General food boxes – including meat, fruit, vegetables, dairy and groceries in general.

- Recipe boxes – sometimes also called a ‘meal kit’, they contain the right amounts of specific ingredients to make certain recipes, with instructions included.

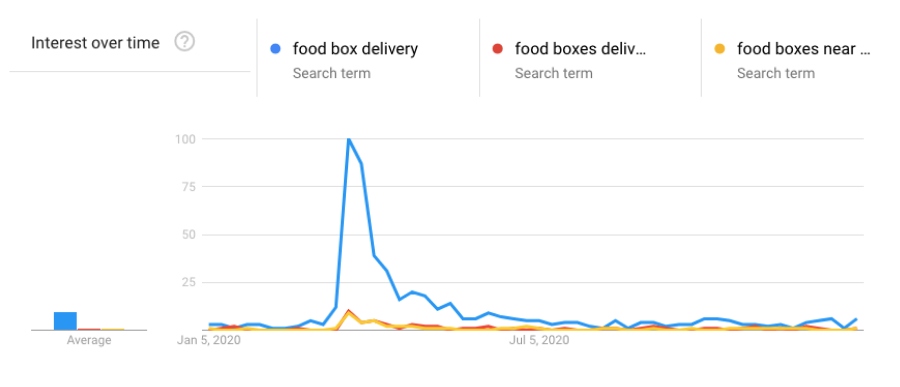

All are delivered to your door and so provide another way of getting food to your home. Food box delivery existed before the pandemic but online interest in food boxes had been consistently quite low for five years prior to the first lockdown, as this graph indicates.

Looking at ‘food box delivery’ (blue), ‘food boxes delivered’ (red) and ‘food boxes near me’ (yellow), we can see that, as with general food delivery trends, there was a spike at the start of the first lockdown. ‘Food box delivery’ had the largest spike in interest, with smaller increases for the variant searches.

Now let’s look at how that breaks down by type of food box.

General Grocery Food Boxes

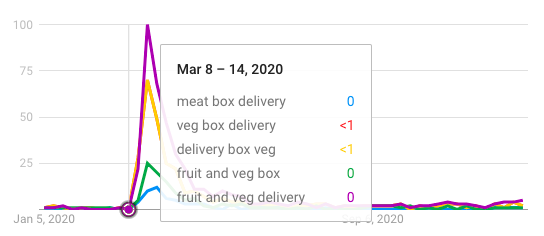

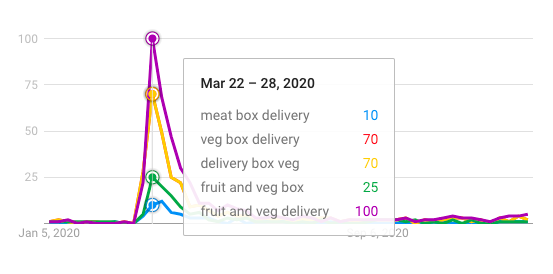

A snapshot of some of the food box searches around ‘meat box delivery’ and ‘fruit and veg delivery’ reveals that all shared a late March (22nd to 28th) boost in interest.

Interest in grocery delivery boxes was negligible before the pandemic started, with levels at 0 or less than 0 compared to the peaks reached in late March 2020.

‘Fruit and veg delivery’ had the largest increase from 0 to 100. ‘Veg delivery box’ and ‘delivery box veg’ from 0 to 70.

Interest levels in food boxes did drop to lower levels by May 2020 and then there is a consistent rise and fall in interest for the various grocery box types throughout the second half of the year.

Recipe Boxes & Meal Kits

Meal kits and recipe boxes are, for all intents and purposes, the same product. Interestingly, compared to ‘food box delivery’ neither saw a spike in interest at the start of the first lockdown. This is very unusual compared to the other food delivery searches in 2020.

Instead, what we see for ‘recipe boxes’ and ‘meal kits’ in 2020 is an initial continuation of the gradual increase seen in the last 5 years.

This slow growth in interest for ‘recipe boxes’ and ‘meal kits’ in 2020 is clearer if we remove ‘food boxes delivery’ from the Google Trends graph.

The large spike at the end of this graph is actually the end of 2020 and first month of 2021. As we entered Lockdown 3 in the UK on 26th December 2020, there was a surge in interest for ‘recipe boxes’ and ‘meal kits’. This was perhaps because people were settling into a new normal and were getting more interested in being given ideas for what to cook at home.

Interest in meal kits grew by 300% between December 2020 and January 2021. December 2020 saw an interest level of 25 (at most) and by mid-January 2021 had reached 100.

Recipe Box Brands

Three of the biggest recipe box brands in the UK are: Gousto, HelloFresh and Mindful Chef, though they are certainly not the only ones. Looking specifically at how these brands have done in the last few years, and in 2020, reveals some interesting insights into how people have been eating.

Over the last few years, there has been a gradual, if slow, increase in interest for Gousto and HelloFresh, with a smaller increase in Mindful Chef. The core difference between these is that Mindful Chef is a ‘nutritionist approved’ healthy recipe box, while the others offer a variety of meals including healthy and dietary options.

All three meal kit brands had a boost in interest during the first lockdown at the end of March 2020, following a January increase, likely in line with resolutions to cook and eat more healthily. This naturally led to a February decline as convictions for healthy resolutions waned.

What makes these specific recipe box brands interesting is that this wasn’t a flash-in-the-pan increase in interest in early 2020. For HelloFresh in particular, this spike was actually a sign of a greater interest in the product that was then sustained throughout the year with additional peaks in September, October and at the end of December. Gousto enjoyed increased interest throughout the year. Mindful Chef saw some waning in interest after May.

The start of lockdown 3 and New Year 2021 led to another rise in interest in all three brands that continued throughout January 2021. Interest almost doubled for most of these brands between the end of 2020 and start of 2021.

Unique Food Delivery

To conclude this dive into food delivery statistics and trends in 2020, we wanted to look beyond standard grocery or hot meal deliveries. Let’s look at some of the more unexpected types of food delivery that took off in 2020.

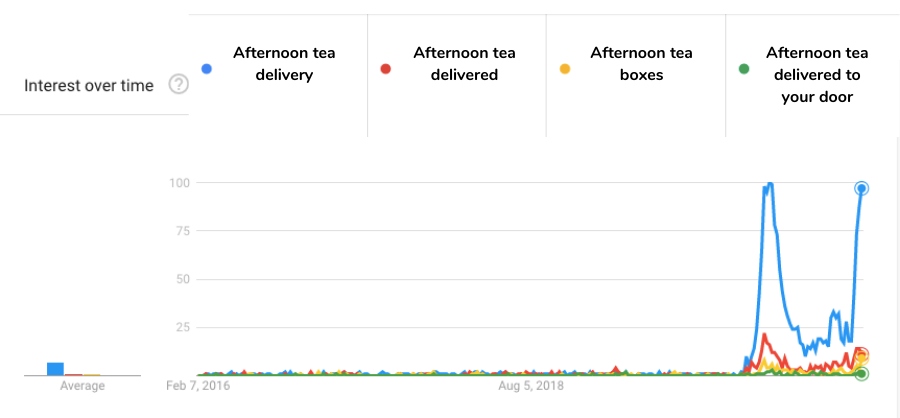

Afternoon Tea

You might be surprised to learn that afternoon tea delivery saw a huge boost in interest in 2020. This didn’t occur at the start of the lockdowns – it turns out groceries were more important then – rather there was a significant spike in interest in May and June of 2020. ‘Afternoon tea delivery’ then saw a consistent, if lower, elevated interest level for much of the rest of 2020, with another spike at the start of 2021.

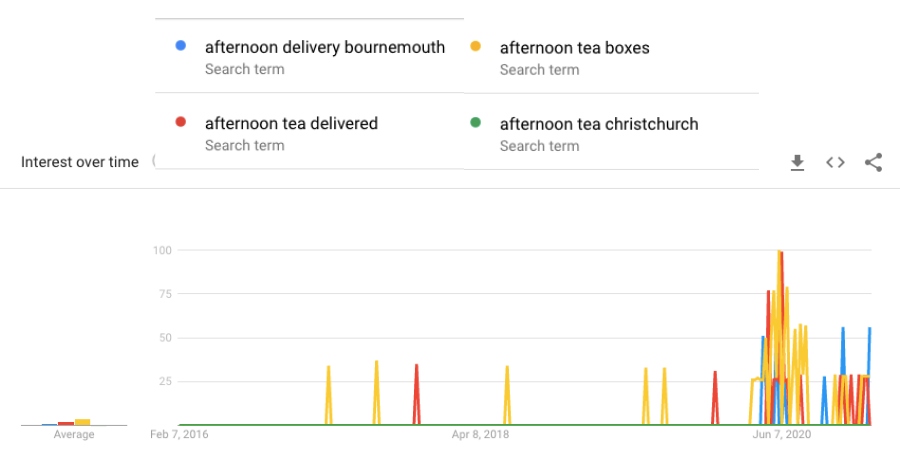

This boost in interest is most stark when we compare specific search terms over the past five years, namely ‘afternoon tea delivery’, ‘afternoon tea delivered’, ‘afternoon tea boxes’ and ‘afternoon tea delivered to your door’.

Certainly ‘afternoon tea delivery’ was the most popular, rising far above the others, though they all saw increases in 2020. Local area specific searches saw increases too. For example:

These particular locations were chosen as they were suggested by Google as popular additions to searches for ‘afternoon tea delivery’.

Interestingly, the interest within certain areas spiked at different times, though commonly between April and May 2020, and then between November 2020 to January 2021.

Essex and Leeds were places that had previously had a larger interest in afternoon tea delivery, in years gone by, and this would be repeated at a higher rate in 2020.

Cocktail Delivery

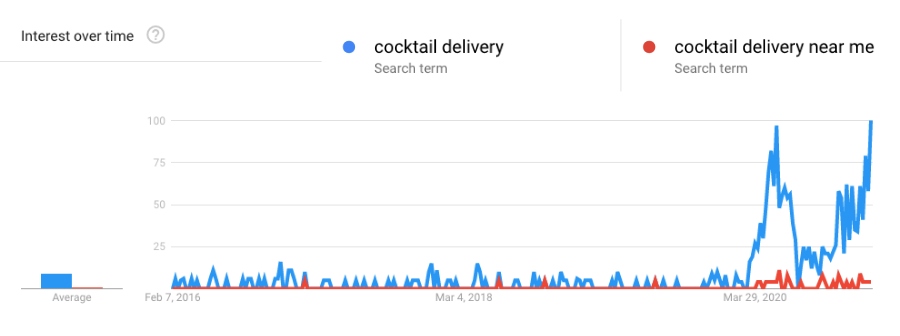

To wash down all that delivered food, we also took a look at one of the unexpected drink delivery requests for 2020. ‘Cocktail delivery’ spiked in interest around April 2020 and then started rising again from around September 2020 to the end of the year.

Clearly, many needed a drink by the end of the year and felt like treating themselves.

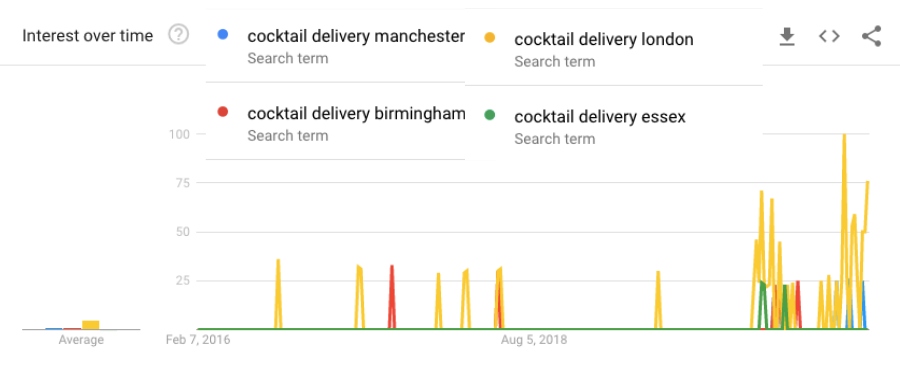

Cocktail delivery to certain areas peaked at times throughout the year, though mostly between April and June of 2020.

2021 Food Delivery Trends & Statistics

What will 2021 hold for food delivery? COVID-19 vaccinations have begun, which could enable businesses to reopen and get people back out into the world. However, how fast this happens remains to be seen.

The first half of 2021 may well mirror the end of 2020. It’s very likely that at least some of this increased interest in food delivery will prevail, even when the world is open for business as usual. Consumers will have become used to food delivery, and to enjoying the many options available. So, food businesses are advised to take notice of the trends that evolved in 2020. Not just so they can adapt to the pandemic, but so they’ll be ready for the post-pandemic world too.